Lending

Contact Us

- Language Assistance

- Our business advisors speak English, Spanish, Somali, and Hmong

Small Business Loans

As a Community Development Financial Institution (CDFI), MCCD provides capital to qualified entrepreneurs including those who face challenges in accessing the commercial banking system, with a focus on Black, Indigenous and People of Color (BIPOC), women, low-wealth individuals, and geographic areas of underinvestment.

MCCD can provide low interest rates of 4.5%-7% with flexible terms. Rates are subject to change due to market conditions.

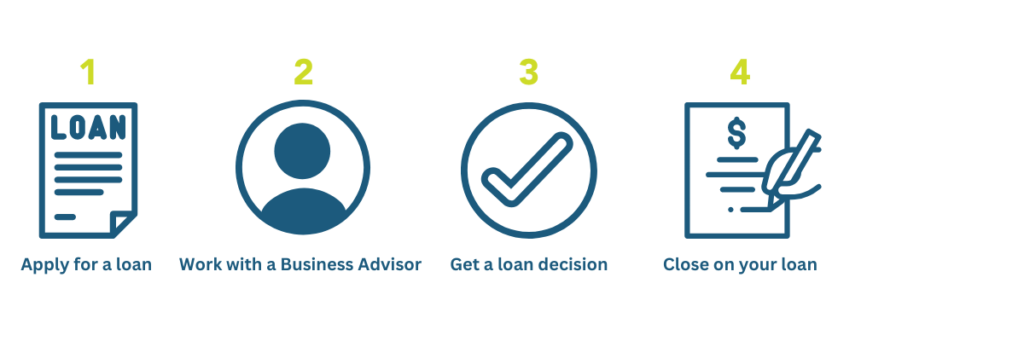

Loan Process

Loans for Start-up Businesses

Direct lending targeted at start-up or early- stage businesses unable to secure financing from traditional lenders.

Micro Loans

Designed for start-up and early-stage businesses. 3 – 5 year terms with loan sizes up to $25,000 for retail or service businesses and up to $50,000 for manufacturing businesses.

Advisor Express

Loans up to $5,000 for small and early-stage micro-enterprises. Loan terms range from short turn around (financing for an event) to terms of 3 – 5 years.

Loans for Start-up Businesses

Direct lending or in partnership with banks, financial institutions, or nonprofits. Includes projects financed traditionally or through the SBA 7(a) and 504 programs.

Gap Financing

Designed to benefit the borrower so working capital can be preserved in the business. Loans provided in partnership with banks or lending institutions for a range of business projects including business or equipment purchases and leasehold improvements. Loan size and terms vary and can be as low as $5,000.

Commercial Real Estate Gap & Acquisition Financing

Financing for real estate acquisitions and property improvements for small business owners. MCCD Loans provide a portion of the small business owner’s required equity contribution. This is permanent term financing with terms up to 10 years (with longer amortizations) and no prepayment penalties.

Other Opportunities

Cooperative & Employee Owned

Financing for member/employee owned cooperatives and other democratically owned businesses including Community Land Trusts. This product is available for projects primarily benefitting BIPOC communities, women, veterans, and low-wealth neighborhoods.

Fee-Based Financing

Alternative fee-based financing is available for start-up and growing businesses.

Credit Building Program

An alternative to traditional marketplace with a safe and low risk product. Through credit coaching we offer non-predator lending, small dollar loans, low monthly payments, and on time payment reports to all three credit bureaus.